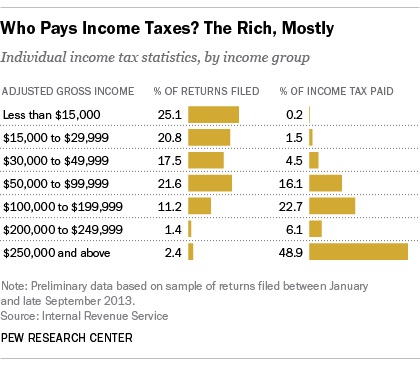

Less than 2% of the population already carries more than half the tax burden. History shows that it may soon get even worse for High Net Worth taxpayers.

The United States has always leaned much further to progressive income taxes than collections on regressive sources like consumption or value-added taxes. This burden on higher income earners reaches all the way back to the civil war when the Union had to sell the war by raising the top rates to quiet complaints of, “a rich man’s war but a poor man’s fight.”

High Net Worth individuals now pay more than half the taxes in the United States. That’s 55% of the tax burden paid by just 3.8% of the income tax-paying population. Worse still, only about 51% of Americans have any tax liability at all so that 55% of revenues is really coming from just 1.9% of the population.

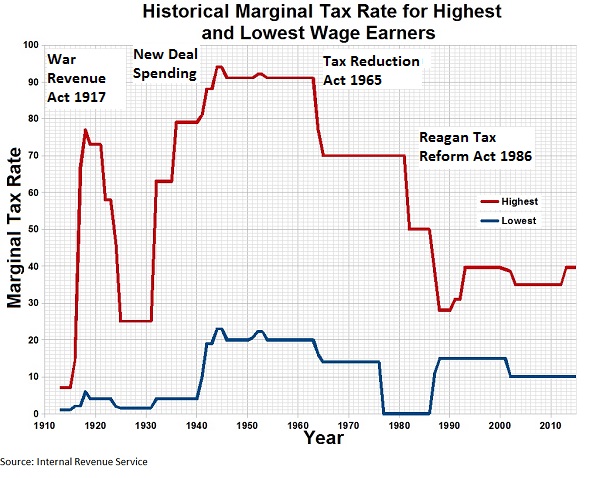

There’s good reason to believe that it’s about to get even worse for High Net Worth taxpayers. Even as the top marginal tax rate surges during the current Obama Administration, history shows that rates can still go much higher.

The top marginal tax rate soared to 94% in 1944 on combined spending for the New Deal and World War II. Taxes didn’t start coming down for more than two decades and really only approached current rates during the Reagan Administration.

The media loves to blame corporations and High Net Worth taxpayers, claiming the two groups control the government, but the idea doesn’t play out when you look at the disproportionate burden on taxes. The total tax burden on many is well over 50% when you include state and local income taxes.

In fact, wealthy taxpayers in the U.S. pay more than their share compared to other developed nations. The top rate in Israel is just 17% and self-employed individuals in Poland can opt for a flat rate of 19% on their income. Even in the European Union where base income is taxed at higher rates, the total tax burden is lower because of lower rates from local governments.

The fact is that it’s populist sentiment and the media that controls politics. Politicians know that they need to jump on the populist bandwagon to secure reelection every few years.

High Net Worth taxpayers are no strangers to even higher rates and out-of-control public spending may just bring back the rates of the 1940s. Washington doesn’t dare cut spending and anger populist voters so the easiest target will be the wealthy and the growing meme of wealth redistribution.

The Only Way to Save Your Money from the Tax Man

Income limits for contribution to a Roth IRA account start fairly low and you’re ineligible to contribute once you make $132,000 or more. There is a back-door way of getting tax-free income in retirement through a Roth IRA conversion. There is no income limit and no conversion limit to how much you can put in your Roth IRA.

You will need to pay income taxes on the amount converted but can withdraw the money in retirement tax-free. Since rates are likely to be much higher in the future, it’s one of the best ways of keeping your money safe from the growing reach by the government. Conversion rules even allow you to rollover 401k accounts into a Roth IRA.

While contributing to a traditional IRA or a 401k account may not save you from paying higher rates in the future, contributing today will still save on current taxes. Knowing the rules for a Roth conversion may be the only way to avoid soaring taxes on High Net Worth taxpayers.