There’s good and bad news for retirement plan contributions in 2016, learn what has changed and how to meet your goals

Inflation below 2% is a good thing for the most part but it also means bad news for retirement plan contributions in 2016. You won’t be allowed to make bigger contributions to your retirement accounts this year than what was allowed in 2015 and it doesn’t look like the stock market will help your portfolio much.

Fortunately, there were some increases to income limits on 2016 retirement plan contributions and there’s a back-door trick that might allow you to take advantage of one great tax-diversification strategy.

401k and IRA Contribution Limits Go Nowhere

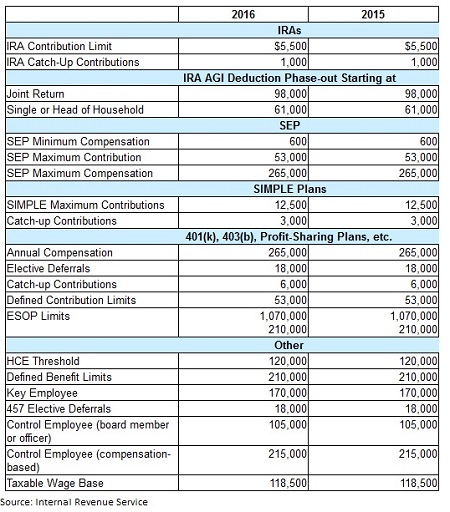

Since the cost-of-living increase didn’t meet the regulatory mark to trigger adjustments, the contribution limits for most retirement plans won’t be increasing this year. For contributions to a 401k, 403b and most 457 plans, you will be able to contribute a maximum of $18,000 for the year. You’ll still be able to make an additional contribution of up to $6,000 if you are 50 years or older. You’ll also be maxed out at a contribution of $5,500 in your IRA with an additional $1,000 for catch-up contributions if you’re 50 years or older.

The contribution limits do not affect many 401k savers with only about 10% of workers maxing out their contributions each year according to Vanguard. Nearly half of savers (43%) max out their IRA plan contributions each year.

Income Limits Increase for Some Retirement Plans and Credits

The good news is that the income limits are increasing for some retirement plans and credits. Eligibility to make Roth IRA contributions will increase by $1,000 in 2016. You’ll be able to make up to $132,000 or have joint income of up to $194,000 and still contribute to a Roth IRA account.

While the income cutoff for contributions to a traditional IRA for those with a workplace retirement account remain the same in 2016 (up to $71,000 income), the income limit increases $1,000 to $184,000 for couples where only one spouse has a workplace account. If both you and your spouse are not able to take advantage of a workplace retirement account, it is absolutely critical that you max out your IRA contributions.

The income limit for the Retirement Savings Contribution Credit will increase in 2016. This is a great tax saving tool because it gives you a credit instead of just a deduction. Single savers will be able to make up to $30,750 and married savers will be able to make up to $61,500 in 2016 and still be eligible for the credit. If you qualify, you can take between 10% and 50% of the money you put into a retirement account as a credit against your taxes up to $2,000 for each saver.

Making the maximum contribution on your retirement plan contributions each year isn’t only about retirement planning but also a good way to save money on taxes as well. Even if you are well on your way to meeting retirement goals, check the difference it makes on your taxes by contributing as much as is allowed.