Learn the worst retirement mistakes that cost people money and keep your retirement planning on track

As retirement approaches, we all look for simple ways to plan and save. Many people are confused or even misled by some common misconceptions which could lead them astray. A few simple rules of thumb can help avoid the worst retirement mistakes and provide for security.

For example, the 4% retirement spending rule suggests that you can safely spend four percent of your stocks and bonds each year in retirement, with adjustments for inflation. The “100 minus your age” rule addresses the percentage of savings recommended for stock investments. These over-generalizations and myths can lead to huge retirement mistakes.

Many planners unknowingly rely on retirement myths which could result in future financial woes. Here are five of the worst retirement mistakes:

Social Security will provide enough to cover your expenses.

Current inflation is low, so there is no need to worry about it.

You may receive an inheritance to supplement your retirement.

The Stock Market will provide additional income down the road.

You can always return to work if you need to.

Let’s look at each of these retirement mistakes in some detail.

Retirement Mistake #1: Social Security will Provide Enough

The average Social Security benefit is $1,328 per month. That’s only $15,936 per year, which is barely above the poverty line for a couple. Full retirement age is now 66 and the maximum possible benefit is $2,663 per month. If you wait until age 70 to retire, the maximum would be $3,501, or $42,000 per year.

The maximum benefits only apply to those workers who were earning more than $100,000 per year for most of their careers. Keep in mind, these are today’s figures. Social Security continues to push the full retirement age back and there is no guarantee that today’s benefits will be available when you reach the required age. In fact, as of March 19, 2015, the Social Security liability is $13,784,756,000,000 and rising rapidly.

Retirement Mistake #2: Inflation won’t be a Problem

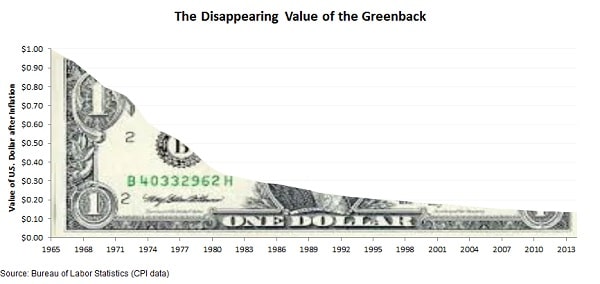

Some advisors think inflation is dead and deflation is headed our way. Despite massive stimulus programs by the Federal Reserve, inflation has slowed to about 1.7% annually. We also have had years in the past, specifically 1980, where it went up more than 13 percent so super-low inflation over the last few years may be the exception rather than the rule.

Since 2000, inflation has been averaging 3% so the $100 you earned in 2000 is only worth about $72 today. In fact, it takes just 22 years to halve the value of a dollar on 3% inflation.

Retirement Mistake #3: Depending on Relatives for Retirement

Even if you come from a wealthy family, beware. Some of the most affluent people are enjoying longer, better lives and actually outliving their assets. This is especially true if they don’t have long-term care insurance and wind up in nursing homes which can cost thousands of dollars per month. Depending on relatives may be a retirement mistake because everyone may be in the same boat at the same time, trying to pay for higher retirement costs and coming up short.

Retirement Mistake #4: The Stock Market will Provide all I Need

The market has been doing well since 2009 and has provided a good return for those wisely invested in the stock market and mutual funds. However, we can’t forget 2008 when U.S. workers lost an average 24.3% in their 401k accounts, according to a study from the Employee Benefits Research Institute and the Investment Company Institute. After retirement, use the stock market for solid, long-term investments, but don’t use stocks for any money you might need in the next five years.

In fact, legendary investor Jack Bogle recently forecast returns of just 6% on stocks and under 3% for bonds over the next decade. This is before inflation so real returns on your money will be much lower and may not cover expenses in retirement if your relying on just stocks and bonds.

Retirement Mistake #5: I’ll just find another job

The Government Accountability Office reported that Americans over the age of 55 are the least likely to find another job and the most likely to take a significant pay cut for the next position. Even when older people find new work, the new wage is typically only 85 percent of the old salary.

Experts told the GAO that employers are reluctant to hire older workers because they “expect providing health benefits to older workers would be costly.” Others said computer skills often hold back the elderly, especially when the job application is all online. More than 1 million older Americans have been looking for work unsuccessfully for more than six months, while hundreds of thousands of other older workers have stopped searching.

Steps to Avoid the Worst Retirement Mistakes

Rather than depending on outside forces to provide a comfortable retirement, you can take control of your retirement and carefully plan for your own future. Diversification is key. Consider not only stocks and mutual funds, but also tangible assets such as gold and silver or real estate which may be beyond the reach of the government and not tied to stock and bond market volatility.

Start now by reviewing your retirement accounts and understanding your IRA investment options. . If you have more than one account, it is probably best to consolidate numerous plans into a comprehensive IRA. Consider investing in assets such as precious metals, like gold and silver, real estate, foreign currencies or even businesses. Go to www.401krollover.com for more information. Our experts can help you select the best options for your unique retirement needs and avoid the worst retirement mistakes that cost people money and their financial security.