After years of hard work, saving and planning, you have finally reached retirement. Now the most important question on your mind is, “Will my money last for the rest of my life?” In 1994, a financial planner named William Bengen developed one of the most popular rules of retirement spending. The 4% rule of retirement spending caught on quickly and has been quoted by nearly every advisor. The rule has become a safety net for many advisors and their clients and is based upon the following parameters:

- Your retirement portfolio is comprised of one-half stocks and one-half bonds.

- In the first year of retirement, you calculate 4% of the total account balance. This is the amount of money you can spend within that first year. For example an account balance of $1 million would allow for $40,000 based on the rules of retirement spending.

- Every year thereafter, you adjust for inflation and add that adjustment to the original 4% amount. For example a 3% inflation rate would allow for an additional $1,200 of spending in the second year, or a total spend of $41,200.

- If you do not spend more than 4%, adjusted for inflation each year, your account will provide a steady stream of funds while also keeping a balance well past your 125th birthday.

A Little History about the Rules of Retirement Spending

How did Bengen settle on 4% rule of retirement spending as the appropriate annual withdrawal amount? It starts with the unrealistic assumption that stocks and bonds can produce an annualized rate of return of 7%. This figure was based upon information gathered twenty years ago. Since Warren Buffet had predicted that the US stock market will experience a 7% long-term annualized return for the next few decades, we’ll play along, for now.

Next, the rule assumes that inflation will erode the dollar value at the rate of 3% per year. Reducing the 7% annualized rate of return by the 3% rate of inflation leads to an annualized real return of 4%. Bengen then reviewed studies of stock and bond returns dating back to 1926. At that time his retirement spending rule worked in every historical 30-year period, as well as in most computer simulations based on the historical rate of return.

At first, the rule on retirement spending gave many retirees a sense of comfort and security. They just needed to set up a retirement account, save as much money as possible and then set up the 4% rule and forget about it. However, based upon the changing nature of our economy over the past 20 years, the 4% retirement spending rule just doesn’t fit as well anymore and it can’t provide the return most investors crave in today’s economic environment.

What has Changed Since the Rules of Retirement Spending were Suggested

Financial advisors are concerned about multiple factors which have changed in the 20 years since Bengen’s rules of retirement spending were proposed.

- Interest rates are so low now, they will almost certainly increase, which will negatively affect stocks and bonds

- In 2014 the true rate of inflation, per ShadowStats.org, was 9.4%

- The stock market has crashed and rebounded several times making one average forecast inappropriate

- Global central banks’ money printing programs could have serious consequences on the rate of inflation going forward

- Age-related healthcare costs are skyrocketing according to the U.S. Department of Health & Human Services.

- People are living longer on average

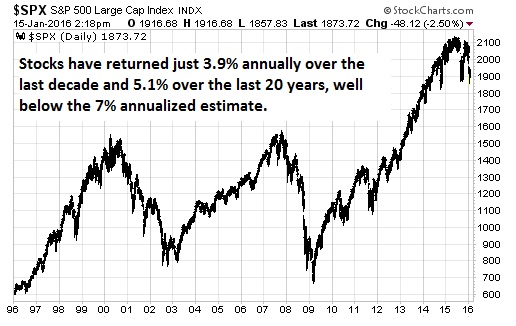

The fact is that the stock market has missed Bengen’s estimated return by a long-shot and multiple market crashes make even the long-term return unlikely. The future return on stocks and bonds is likely to fall well short of expectations, turning the rules of retirement spending upside-down.

So Does the Retirement Spending rule Still Fit Today?

The key to the 4% retirement spending rule is the expected rate of return on stocks and bonds which is required to replace the amount being spent each year. Wade Pfau, professor of retirement income at the American College for Financial Services, argues that asset prices have less room to rise in the future and the long-run outlook calls for lower returns ahead. For example, the 10 year Treasury bond is currently yielding 2.1% as opposed to its historic average yield of 3.5%. Today’s 10-year yield will generally predict the total return expected for the next decade.

Pfau also raises concerns about stock values. According to Robert Shiller, a noted Yale economist, the large companies which are included in the S&P 500 index are currently priced at 25 times their averaged earnings over the past decade. These prices are significantly above the overall historic average of 16 times earnings. When the price to earnings ratio is high, you can expect lower returns over the next 10 years.

As a result, Pfau is predicting that a portfolio consisting of half stocks and half bonds will realize a annual return, after inflation, of only 2.2% over at least the next decade. If Pfau is correct, a retiree following the 4% rules of retirement spending, with an adjustment for inflation, will run out of money 57% of the time.

So what does this mean for the average retiree? It really depends upon your investment and spending strategies. There’s really two options for investors and new rules of retirement spending. You can decrease your spending rate to 3% which will spread your retirement funds out. For a lot of retirees, this isn’t really an option because of low retirement savings. You can also look for higher returns in alternative assets like precious metals. While gold and silver prices have languished for several years, key factors are coming together that may increase demand just as supply is shrinking. Investing just 20% of your retirement accounts in precious metals could increase your long-term return by several percentage points.

Because of the changes we have seen in the past 20 years, most advisors agree that the 4% retirement spending rule should be nothing more than a starting point for discussions about spending after retirement, and preservation of assets during retirement, to ensure continued financial freedom.

Steps to Take Beyond the Simple 4% Rule of Retirement Spending

Here are some better retirement suggestions to follow:

Be flexible during retirement – both in investing and spending. Reevaluate your financial situation frequently throughout your retirement years. Adjust spending annually, if necessary. Pay attention to the markets when deciding if you can afford that new car this year, or if you would be better served to wait a while. Match your spending and life experiences with your investment performance.

Diversify. Do not just invest in large-cap stocks and bonds. If you invest in assets other than stocks and bonds, you can realize a greater spending potential since your withdrawals are not solely dependent upon market fluctuations and inflation or interest rates. Understand your IRA investment options and the flexibility you have for investing with an IRA transfer from old 401k accounts.

According to John Halloran of Certified Gold Exchange, “Even though interest rates are almost zero today, they are poised to rise for the next 20 years. With government liabilities increasing, you can bet Uncle Sam will try to spend its way out of debt. This uncontrolled spending will really affect the purchase power of many hard-working Americans. Investing in safe havens like gold and silver really debunk the 50% stock 50% bond recommendation which is the basis of the outdated 4% retirement spending rule.”

The best rule today may be to not follow rules of retirement spending at all. Retirees need to be active participants in the management of their retirement savings and adjust spending where needed. Consider a 4% spending cap, but remain open to modification and diversification in order to ensure the comfortable retirement you have worked so hard to enjoy. Let our experts at 401krollover.com help you make the best decisions for your particular needs. Contact us through our website at www.401krollover.com for your own personalized plan.