New banking regulations are setting up the financial industry for bank bail-ins and massive depositor losses. The only way to protect your money could be to get it in hand and preferably out of assets tied to the U.S. dollar or any of the world’s 180 fiat currencies.

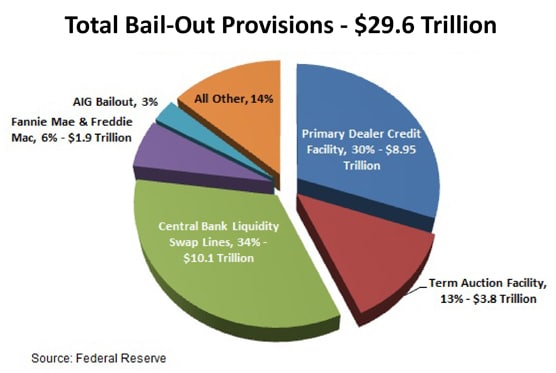

Most Americans are still fuming over the $29 trillion taxpayer-funded bail-out of the big banks, which began in 2008. When the crash in derivatives came, the U.S. government was more than happy to devise a plan with their banking brethren that ended up costing taxpayers trillions, including $3 trillion that was used to bail-out foreign banks and $10 trillion loaned to foreign central banks.

We’ve been led to believe that financial regulation such as the Dodd-Frank Act is protecting us from future bail-outs and that the banks are financially healthy once again.

The truth is that something much worse is coming, something more than ten times worse than the $29 trillion bailouts. Regulation has already been passed that makes it as easy as the swipe of a pen for banks and other financial institutions to hold your assets in lieu of stock.

After You Experience a Bail-In, You will Wish for Bank Bail-Outs again.

Enter bail-ins. In the event of financial distress, a bank is now authorized to prop itself up by converting the debts it owes to stock or just writing them off entirely. For those without an accounting degree, the debts a bank owes are deposits, money market products and loans it sells to investors. Depositors and others with money in these products are called “unsecured creditors” because they have loaned the bank money without collateral. To save itself from insolvency, banks will wipe out these unsecured creditors or give them worthless stock in exchange.

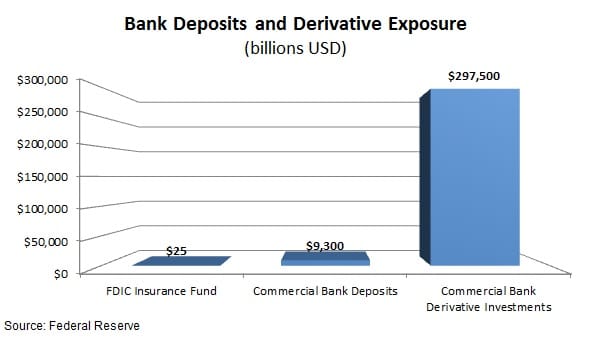

If you think your money is safe on the FDIC’s deposit guarantee or that you don’t have much at risk, think again. The FDIC insurance fund, from which it “guarantees” deposits of $250,000 or less, holds just $25 billion. That’s less than a quarter of a percent (0.25%) of the $9.3 trillion in deposits held at U.S. commercial banks and dwarfed by the $297.5 trillion in total derivatives held in the banking system.

Even a hiccup in derivative prices will have the banks filling the gap with depositor money and the FDIC insurance fund will quickly run dry.

But the risk goes well beyond your checking and savings account. Pension funds and insurance annuity companies both invest heavily in bank debt because it is seen as a safe investment with a stable return. These institutional investors were nearly wiped out in the previous financial crisis and have fled to the perceived safety of bank debt. The $9.3 trillion in deposits will not be able to keep banks solvent when hundreds of trillions in derivative investments go bust, and they’ll convert all creditors to close to worthless and certainly illiquid stock.

The complete collapse in value of bank accounts, pension assets and annuities will make the Great Recession look like a bath-tub fart compared to the approaching 100 foot tsunami this bail-in crisis will unleash.

Bail-Ins are already 100% legal and this monster is coming to an institution near you.

The bail-in was institutionalized in November 2014 when the Group of 20 nations (G20), including the United States, approved its use through the Financial Stability Board (FSB). The FSB, at first an advisory board but now allowed to regulate global banking, approved the “Adequacy of Loss-Absorbing Capacity of Global Systemically Important Banks in Resolution” to prioritize the payment of bank derivatives above all other creditors. That includes your deposits and sets the stage for banks and insurance annuity brokers to pass the tab to you when their junk derivatives go bust again.

Bail-ins have already been used internationally. Bondholders in Britain’s Co-operative Group were forced to concede £1.5 billion ($2.4 billion) in a June 2013 bail-in. Bondholders were forced to swap their old debt for new bonds and equity in the bank, so the Co-op group could provide financial support for its banking unit.

In the United States, the new Foreign Account Tax Compliance Act (FATCA) has helped close the noose on depositors looking to protect their money internationally. The Act requires foreign banks to reveal Americans with accounts, reporting account numbers, balances, names, addresses and U.S. identification numbers on those accounts.

Banks that don’t play ball will be frozen out of U.S. markets. More than 80 countries and 77,000 financial institutions have agreed to the Act so as not to get shut out by the U.S. government. The threat and repercussions are so severe that even China and Russia have signed on to the Act.

In August 2014, Vice Chairman Fischer of the Federal Reserve Board gave a speech previewing a proposal requiring “Too Big to Fail” banks to ready themselves for bail-ins by issuing special debt and a “gone concern” buffer.

The solution, if it’s not too late, is to get control of your money. Besides any money directly deposited in a bank, any assets you have in a pension fund, insurance policy, annuities or managed mutual fund is at risk to bank bail-ins. You don’t need to stick the money under your mattress, but you do need it in an account that you control – a self-directed account.

I suggest you contact one of the massive reputable precious metals dealers like the Certified Gold Exchange, or one of the other top-tier firms, and ask them to help you set a physical metals strategy for your cash holdings and retirement assets. As we know, besides the big banks, the annuity companies are tip-toeing on the edge a very steep cliff so these assets should be the first you safeguard.

It may be too late to stop the next collapse of the financial system. Regulators and other insiders are already planning it and how it will unfold. It may not be too late to protect your own assets from being appropriated by the banks and insurance companies, but time is definitely running out.