The 401k Withdrawal Process

When you apply for a withdrawal, whether you are cashing out your entire 401k or if you are just withdrawing a portion, you will contact the 401k administrators to begin the process. Most plans will automatically send 20% of your withdrawal to the IRS to cover 401k withdrawal penalties and a portion of your taxes. When you ask for a withdrawal, you need to keep this in mind and adjust the amount you are asking for if you need a specific amount of money. For example, you may only see $7,000 in a $10,000 401k cash out after the administrator holds 30% back for 401k withdrawal penalties and taxes.

When you withdraw money from your 401k plan, the only money you’ll be able to draw from is the voluntary contributions you made into the account. Any interest earned or the money your employer contributed will not be available for withdrawal.

If you are unsure about the guidelines for your plan, ask the administrator as you begin the process for 401k withdrawals.

401k Withdrawal Penalties

401k withdrawal penalties are in place to discourage you from making a withdrawal. The government understands that if you take the money out of your plan now, you are taking away from your future retirement, when you may not be able to make money as easily. The penalty applies to almost all withdrawals unless under hardship conditions.

There are a few circumstances under which you can withdraw money from your account without facing 401k withdrawal penalties. These are called hardship rules and can vary by provider.

- Unreimbursed medical expenses more than 7.5% of your adjusted gross income

- Purchase of your first home or to avoid eviction or foreclosure

- Payment of college tuition for you or or spouse

- Funeral expenses

Hardship withdrawals will only be allowed if you need the money immediately and have no other source of funds. Withdraw more than you need for the hardship and the IRS may deny the hardship exemption altogether. Hardship rules also only apply for while you are still employed by the plan sponsor.

Understand that even if you avoid 401k withdrawal penalties, you will still need to pay income taxes on the amount. These taxes could be much steeper than the 10% penalty so you’ll want to avoid cashing out your 401k if possible. Withdrawing from your 401k means you won’t be able to make a contribution for six months, missing out on benefits from employer matching and the tax deduction.

Consulting a Professional to Avoid 401k Withdrawal Penalties

In addition to the penalty, you will need to pay taxes at your normal tax rate on the withdrawal. If you are close to the top of your tax bracket, the withdrawal may bump you into a higher tax bracket. If the plan’s administrators only send the 20% to the IRS, chances are that you will owe more in taxes when comes time to file. It’s important to talk to your accountant so that you can set the right amount of money aside and you will not be taken by surprise when it is time to file your taxes for the year.

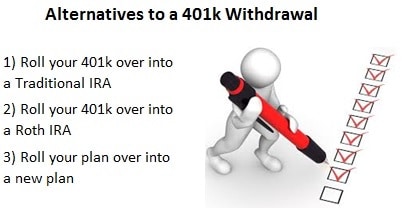

Avoiding 401k Withdrawal Penalties

If you are forced to make a mandatory withdrawal, because you do not have enough in your account to keep it open, you can avoid the penalty and interest by rolling it over into an IRA. You must do this within 60 days of the money being issued to you.