Runaway debt and an unfunded pension system make 401K nationalization not only a possibility but a very real likelihood

According to USDebtClock.org the U.S. federal government is more than $19 trillion in the red. That’s more than $59,143 of debt for every man, woman and child.

Within the runaway government spending that got us to where we are today, Social Security is the second largest cost at $894 billion only less than the annual cost of Medicare/Medicaid at $1.0 trillion. Both of these programs are seriously underfunded and will cost the government trillions of dollars.

Once thought an impossibility, 401K nationalization is looking more likely as a tool for both the Federal government and corporations to cover wasteful spending and rampant corruption.

Is 401K nationalization coming and what can you do to protect your retirement investments?

The Government Moves Closer to 401K Nationalization

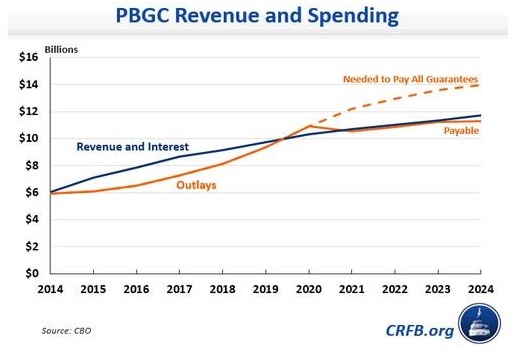

To cover the insurmountable debt, the government has passed a 22% increase in premiums to be paid by employers to the Pension Benefit Guaranty Corporation (PBGC) through 2019. The PBGC was designed to take over bankrupt pension plans and make payments, though payments are normally renegotiated well below what was originally promised by the employer. The new hike costs businesses an extra $14 per employee beyond the 236% increase in per employee costs added by the PBGC since 2005.

Even on the increased premiums to the PBGC, the fund admitted that it was 90% likely to run out of money by 2025.

The combination of building national debt and underfunded needs at both the federal and corporate level means lawmakers and corporate management are going to be scrambling to find money to fill the coming gap.

And that is when 401K nationalization will become a reality.

There are currently about $3.7 trillion saved in 401k plans and other employer-sponsored retirement accounts. Yes, the government knows that we are saving that money to use during retirement, but that didn’t stop them from raiding the Social Security coffers. How long will it be before the government mandates that a certain portion of 401k accounts be invested in government-backed investments like Treasury bonds? After all, just last year the government announced the creation of MyRA plans that are nothing more than bond-based IRAs.

In fact, the Pension Protection Act of 2006 might actually make it easier for 401K nationalizations to become a reality. The law was the beginning of a long list of investor protections that were wiped from the rules, allowing employers to automatically enroll employees and protecting 401K plan sponsors from liability in the event of loss.

What Can Investors do to Protect Themselves from 401K Nationalization?

Protecting your investments from a 401K nationalization or from corporate malfeasance raiding the funds means taking control of your own assets. An investor’s best course is to take control of their retirement investments through the 401K rollover process. A 401K rollover is a relatively easy process where you transfer the assets within your corporate 401K into an Individual Retirement Account (IRA). The IRA benefits from all the same deferred-tax advantages of a 401K and you can make tax deductible contributions every year.

It’s your name on the IRA account and neither the government or an employer has access to it. Learn the differences between 401K vs IRA and critical questions you need to ask. 401K rollover specialists can answer your questions and can help you understand the rollover process to protect your money.

Like and Share this post if you want the government to let you decide how to manage your retirement account funds.